Next, you can calculate your total revenue, as this is a component of gross profit margin. If a cost changes based on how much of a product or service you produce, then it isn't a fixed cost. Fixed costs include any of your company's expenses that aren't affected by the cost of providing your service. Your company's fixed costs include things such as utilities, rent, insurance, property taxes and loan payments.

Follow these steps to find your break-even point in sales: 1. Implementing the break-even formula for sales is simple with some practice.

Break even point formula calculator how to#

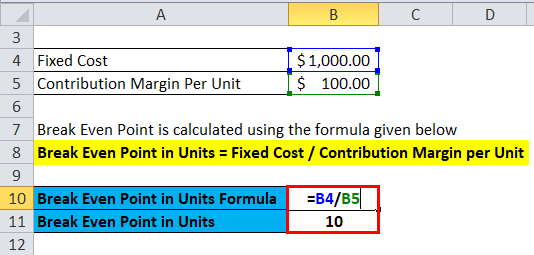

Related: 7 Ways To Market a Small Business How to use the break-even formula for sales You can also use it to determine whether you may consider cutting costs or looking for alternative means of generating revenue. The formula looks like this:īreak-even point = Fixed costs / Gross profit marginīusinesses use this formula to determine when they have become profitable. With the break-even formula, you divide the total fixed costs in dollars by the gross profit margin in decimal form. There is one common formula that business professionals use to calculate the break-even point. Break-even points can also help establish goals for sales teams and drive productivity. It can help businesses understand how much of a product or service they can sell to produce a profit. The break-even point is the level at which total costs are equal to total revenue. In this article, we discuss the break-even formula and share an example so you can see how this metric can affect your financial decisions.

Understanding when you reach the break-even point can help you determine how many products you can sell to be profitable or whether a business idea is viable. The break-even point is a statistic that closely relates to profitability. Direct and indirect costs can be either fixed or variable.Whether you’re starting a new business or launching a product, learning how to calculate a break-even point can help you make better business decisions. Direct costs can be attributable to particular sales, whereas indirect costs benefit sales in general. These include the cost of materials, fuel and sales commissions.įixed and variable costs are not the same as direct and indirect costs. Variable costs change in proportion to the volume of sales and production. These normally include rent and rates, depreciation, accountancy costs and general management salaries. You could do this by raising prices (which may be difficult in your specific market) or by looking at ways to reduce your cost of sales and indirect variable costs.įixed costs are those that stay constant over a given time period despite fluctuations in the volume of production and sales. Look for ways to lower the break-even point by increasing the margin on your sales. Once you know the relationship between sales and variable costs (cost of sales and indirect variable costs), you can calculate the amount of sales you need to cover your fixed costs using our break-even point calculator. The simplest way to do this is from your profit and loss account and the formula is cost of sales/sales x 100. Start by establishing the percentage that cost of sales represents of your sales. Tabulate the indirect variable costs, for example temporary staff, and calculate the relationship of these to sales. Use our Break-Even Point Calculator to record fixed and variable costs separately, as well as doing the break-even calculation for you as follows: Your variable costs will always include your cost of sales but you will also have identified others that are variable (indirect variable costs). Variable costs depend on the level of sales so these need to be calculated together. Once you have identified your fixed costs, it's simple to quantify them.

Break even point formula calculator plus#

The break-even point for your business is where fixed costs plus variable costs are equal to sales. Being clear about the distinction between fixed and variable costs in your business will enable you to more accurately work out the break-even point of any given project.

0 kommentar(er)

0 kommentar(er)